What is Financial Planning and why is it so important to train the right people?

Financial Planning Standards Board Ltd. (FPSB) defines financial planning as a “process of developing strategies to help people manage their financial affairs to meet life goals.” In creating their recommendations and plans, financial planners may review all relevant aspects of a client’s situation across a breadth of financial planning activities, including inter-relationships among often conflicting objectives.

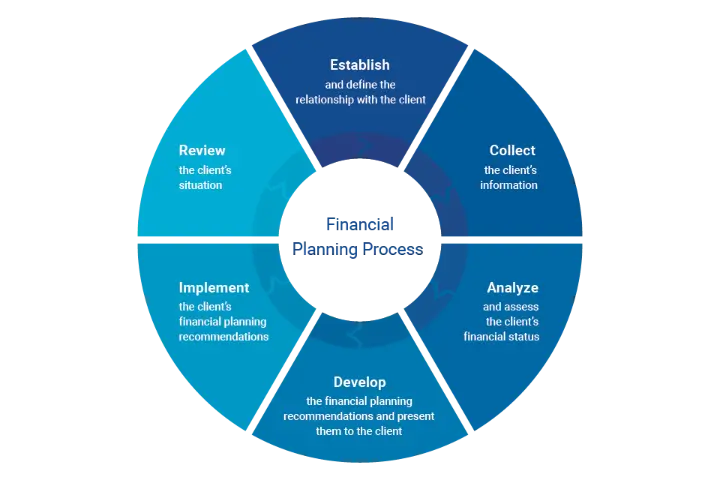

There are normally six steps to the process; namely:

Following a defined and robust process such as this will help financial planning firms reduce their compliance risks and potential claims and will help provide comfort to clients.

For more detail of each step in the six-step process, please go to Financial Planning Process | FPSB

Following a defined and robust process such as this will help financial planning firms reduce their compliance risks and potential claims and will help provide comfort to clients. We know from the FPSB research, that clients who seek help from a CFP professional feel significantly more confident about achieving their financial objectives in the future.

The profession was started in the UK in 1985 when a group of advisers got together to form the Institute of Financial Planning because they were uncomfortable with the financial advice community’s approach to selling product after product seemingly free of charge and not disclosing to their clients that the product providers were paying them commission.

A firm Jackie worked in in later 1990s charge both a fee explicitly to their clients AND took the full amount of commission from every product sold! She was extremely uncomfortable with that!!

Thankfully, with changes in regulation which has seen commission largely abolished and requirements of upfront fees, costs and charges now needing to be fully explained to all clients, those sharp practices have largely disappeared.

Why is financial planning so important?

As individuals we are often reluctant to seek assistance with our finances. At school we are not taught much about money and understandably for many balancing their income and expenditure when they enter the workplace can be very hard. Attending university also often gives many a significant amount of debt for when they start work.

At Lockie Consultants, we believe that seeking assistance with your finances is very important. Finding someone you can trust is often hard especially after the numerous mis-selling scandals that have happened in the UK over the last 40 years.

We all need to know where we stand with our finances and not only that, we want to achieve certain things with our money in the future. But how do we know we’ll have enough money to do that when the time comes? We all need our own financial plan. One that takes into account all our circumstances, wishes and dreams, and looks at how they can best be turned into reality. A financial plan should be clear and logical to follow and as clients, we should see ourselves in that plan. A good financial planner can create a financial plan to do just that.

Training the right people:

Those who started the profession are now getting older and the profession needs to appeal to younger people. Both younger financial professionals and to attract and help younger clients. You’ve probably read many times about the trillions of money starting to pass from the post war baby boomer clients of many advice and planning firms. Where is this money going as these clients die? To their children and grandchildren. Those people need help and support to save, invest and spend what they need in order to achieve their own future objectives.

There are many financial planning firms doing their bit to help attract and retain future generations of financial planners. Lockie Consultants do this too.

Although we are a young business, we help educate and attract the next generation of planners via our YouTube Channel and Journal articles on our website, all free of charge to access. We also influence large wealth and planning businesses and challenge them to continue to evolve and improve for the long-term benefit of the profession.

Our podcasts are yet another free resource that we are developing to help anyone interested in joining the profession by hearing form some of the best financial planners in the world. We also write articles for the financial trade press and try and challenge the reader to improve themselves for the long-term benefit of the public.

Return to Journal